Taking cash systems to the next level

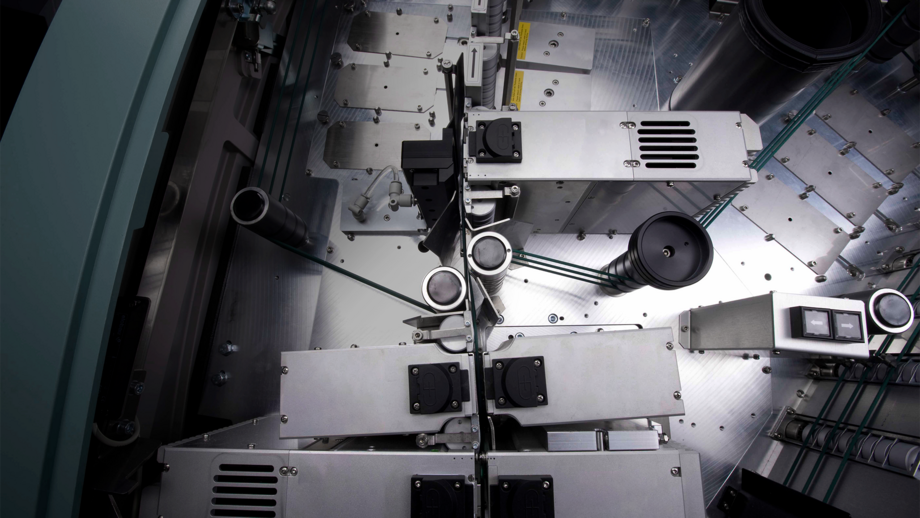

When it comes to rapidly processing high volumes of banknotes, the G+D BPS® M Systems are peerless in the cash industry. They can process up to 120,000 banknotes an hour, 24/7, with unchallenged precision for banknote authentication, counting, and sorting.

In combination with their existing configurable modules, BPS® M Systems already offer high levels of automation – for banknote loading, banding, bundling, and packaging – helping to minimize the workforce needed inside cash centers. But Mevo goes even further.

Productivity is the big challenge for most cash center operators. Fixed costs, which account for a high proportion of their total cash operations costs, are rising in absolute terms as the volume of cash being used at the point of sale has declined in many countries. And those fixed costs – largely comprising infrastructure and people – are historically not easy to eliminate.1

Optimized user interface Mevo software seeks to address that by introducing a new highly intuitive and modern user interface that is designed to intelligently guide operators through the setup and execution of cash processing. For example, it helps them to quickly resolving error situations. The result is a major leap in productivity, as operators can perform tasks faster. But the smart system also assumes a lower level of skill and training among operators, which is key, given ongoing labor and skills shortages in many countries.

Enhanced security With Mevo, IT security has been improved with the introduction of an integrated firewall and encrypted data transmission between cash processing systems and customers’ servers.

Refined banknote classification Customers also benefit from software innovation via SensorFusion®, which uses intelligent sensor algorithms to enable more precise banknote classification. Powered by SensorBrain®, a complementary computer system to BPS® M, SensorFusion®’s algorithms evaluate numerous banknote properties simultaneously, merging measurement technologies that cover note thickness, image, magnetism, luminescence, UV, and ultrasound to more thoroughly check the authenticity and condition of banknotes. This results in a more precise classification of banknotes, while ensuring fewer rejected banknotes with less effort involved in manual handling. That greater accuracy also has a sustainability benefit: it means less shredding of banknotes that may have previously been falsely classified as unfit. Mevo software boasts UV detection with resolution that is 30 times higher than previously, as well as differentiation of the UV colors to fully utilize the banknote’s UV features.