Traditional banks and neobanks from across 15 countries were surveyed as part of G+D’s recent independent market survey, conducted by Global Data, which aimed to find out what financial institutions see as current challenges in the payment landscape, what banks can learn from one another, and how banks can take steps to improve interactions along the customer journey through phygitality.

Are banks ready for the phygital future?

The proliferation of innovations in the payment industry is radically transforming the sector. There are increasing options for consumers, and as customer expectations rise, banks must be quick to react and adapt.

Digital banking and physical branches: a winning combination

With responses from a range of digital and traditional banks across the world, the survey revealed some clear trends. All participants believe that a combination of physical and digital wins, with only 20% of neobanks dismissing the idea of not having a physical presence to be successful in the long run.

Another universal agreement was that 89% of banks (both traditional banks and neobanks) believe that the physical payment card will continue to be relevant in years ahead. A 2021 study by Juniper Research also concluded that while digital-wallet users are set to exceed 4.4 billion by 2025, yet banks still expect digital wallets to coexist with physical cards for years to come.1

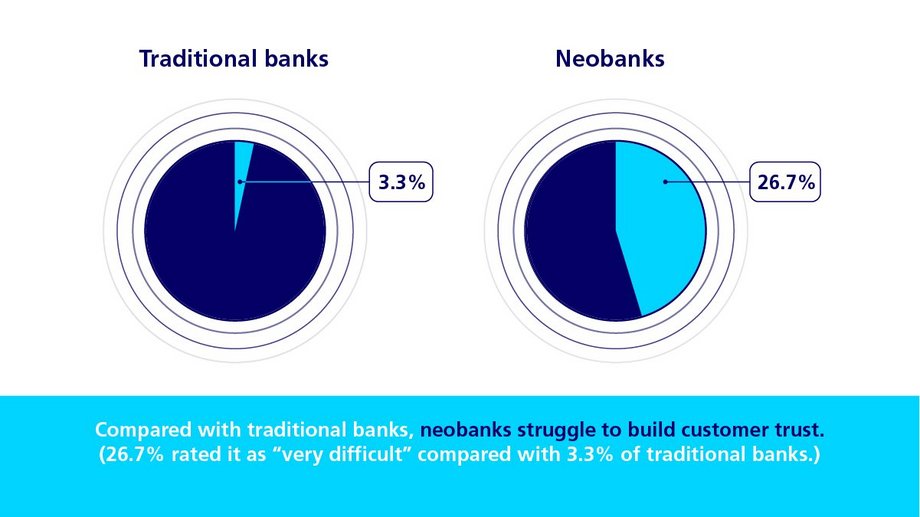

Physical payment cards remain a tangible emblem of trust. Just as e-book sales continue to rise, sales of print books are also growing.2 Physical touch is still very important for us, as humans, and the survey emphasizes this with expectations of payment card longevity. For banks, branded, tangible elements are a way of connecting with customers.

Overcoming banking challenges

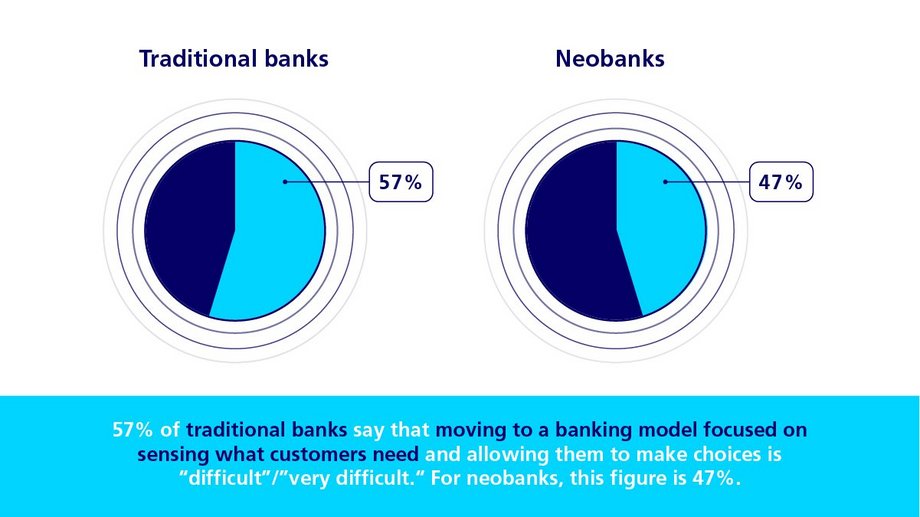

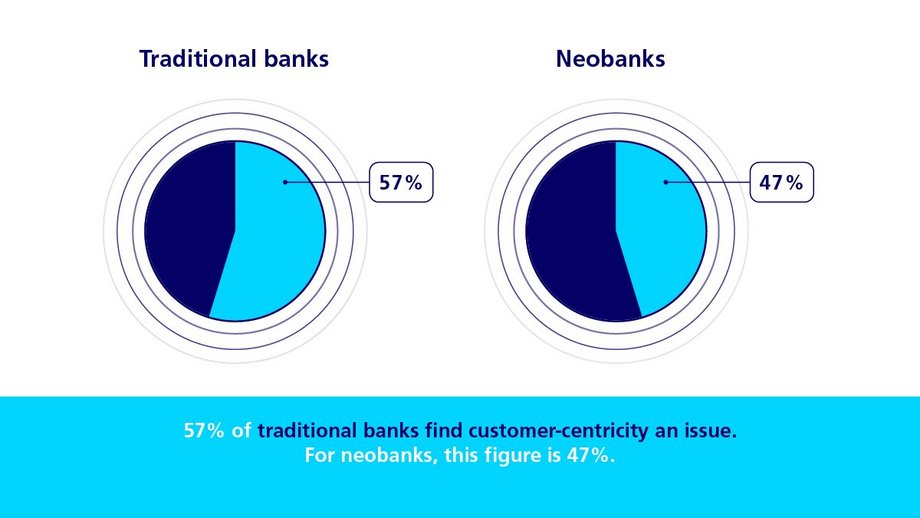

Both traditional and neobanks agree that a phygital approach to customer service is key, yet they both concur that implementing it is a challenge. Specifically, developing a cohesive, consistent customer journey via physical and digital channels is exigent yet complicated. Overall, traditional banks saw this as more of a challenge than neobanks did, with 37% of traditional banks defining it as a “huge challenge.” Linked to the positive trend of dismantling aged legacy systems and taking advantage of new digital services such as open banking systems, these results underline the complexities of integrating sometimes historically grown financial services from a range of providers.

Connecting applications and data with APIs and web services increases flexibility and provides customers with up-to-date service experiences. Alas, solutions licensed in a variety of countries and by different companies can cause bureaucratic headaches for banks who must ensure data privacy and a seamless customer journey. Yet this challenge must be overcome – creating an ideal customer experience and utilizing communication channels effectively is a driver of long-term success.

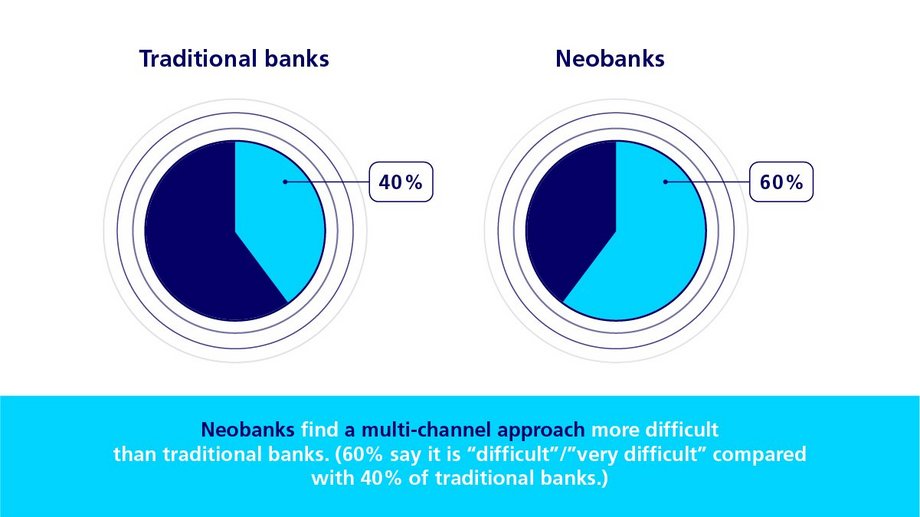

Although neobanks have a competitive advantage by starting greenfield in most cases, they aren’t necessarily leading the way in the communications space. Just under two-thirds of neobanks questioned say that a multi-channel approach of connecting interactions is difficult (compared with 43% of traditional banks). This underlines the necessity for all financial institutions to adapt and learn to thrive in the new phygital world.

Banking expectations for the future

The future of digital is human. That’s the consensus of both traditional banks and neobanks. Both agree that automation is set to play a major role in the future of banking, with 96% of respondents agreeing on this. Both agreed upon the importance of human elements sitting alongside automation (87% of traditional banks and 67% of neobanks). How do banks go about integrating automation as part of their banking strategy? Research has shown that the majority of customer dissatisfaction happens at just a few touchpoints: waiting in line at a bank branch, confusion when using a mobile app, or lack of clarity when completing a customer journey. Chatbots and automated voice responses (AVRs) can provide automated support, but one thing should never be forgotten: sometimes, customers simply want to speak to a human being.

And in summary, it’s that combination that will drive a bank’s success. By combining physical touchpoints and best-in-class smart solutions, banks will be equipped with the tools for success, with both helping to create a competitive advantage – and excel at the customer experience.

Published: 10/03/2022

Share this article

Don’t miss out on the latest articles in G+D SPOTLIGHT: by subscribing to our newsletter, you’ll be kept up to date on latest trends, ideas, and technical innovations – straight to your inbox every month.