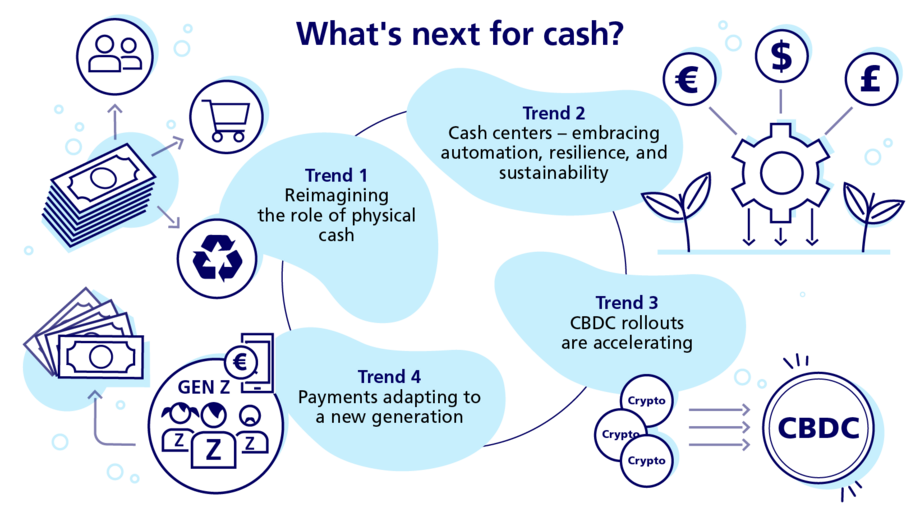

From the coexistence of physical and digital money and the newfound appeal of cash for younger generations to the innovation transforming cash centers, we showcase key trends in public currency.

4 trends redefining the future of public currency

As we head into 2024, Spotlight revisits selected Currency Technology trends from the past 12 months – all of which promise to be even more impactful in the year ahead.

Trend 1: Reimagining the role of physical cash

Despite the growing popularity of digital payment methods, cash continues to play a crucial role in economies, societies, and communities, with its key attributes still highly valued.

Physical cash is inclusive, accessible, and instantly exchangeable. It does not require the sharing of personal data when used, and its critical role becomes even more pronounced during times of crisis, when its ability to bring stability to turbulent economics comes to the fore.

Furthermore, new research shows that different types of crises trigger demand for different banknote denominations. Smaller denominations are in high demand when payment uncertainties arise (such as a sustained bank outage), while larger notes are sought in times of wider economic uncertainty when people want to build up cash reserves. It’s a trend that illustrates shifting patterns of use for physical cash, as its transactional role decreases in some regions of the world even as its use as a store of value rises – the so-called cash paradox (or banknote paradox).1

It also explains why, in recent years, governments and central banks in several countries have felt the need to act to ensure the ongoing availability of public currency. In Sweden, for example, financial authorities have obligated major banks to continue to provide cash withdrawal services country-wide,2 while in France, retailers who refuse to accept cash payments can be subject to fines.3

Trend 2: Cash centers: embracing automation, resilience, and sustainability

Whether operated by central banks, retail banks, or cash-in-transit companies, cash centers play a vital role in supporting the “four As of cash” (accessibility, availability, acceptance, and authenticity) by enabling the smooth flow of valid currency around an economy. Reacting to the evolving role of cash, cash centers are embracing innovation on multiple levels to enhance their efficiency, resilience, and sustainability.

To speed processes and address skills and labor shortages, cash centers are applying higher levels of automation in both high-volume and mid-sized banknote processing environments. This is enabling them to rely on fewer labor-intensive processes – and even eliminate some process steps altogether.

They are enhancing capabilities for the classification and sorting of banknotes, so they can more accurately detect unfit or counterfeit notes and pull them out of circulation. And they are deploying robotic capabilities that can take over manual tasks such as banknote banding, loading, reject handling, and tray filling.

In parallel with their automation initiatives, the geopolitical and economic upheavals of recent years have underscored the need to bring greater resilience to the cash cycle. Players across the cash ecosystem are working together to address challenges at a company, industry, and national level.

Better visibility into the cash cycle, for example, is critical for formulating the best responses to future disruptive events. And different organizations are enhancing their data architectures so they are capable of providing a window into the “cash nervous system.”

Meanwhile, much of the cash cycle is being redesigned to conform to the principles of circularity (reduce, reuse, recycle) by prioritizing renewable materials, maximizing cash center efficiency, and extending the life cycle of banknotes. For example, the use of standardized, reusable cash transport units (such as G+D’s NotaTray®) at key points in the cash handling cycle has the potential to deliver major sustainability benefits by optimizing the movement of banknotes and reducing the utilization of single-use formats.

Trend 3: CBDC rollouts are accelerating

Central bank digital currency, or CBDC, is a digital equivalent of physical cash that is both issued and regulated by a central bank. Designed in order to sit alongside, rather than replace, cash, CBDCs aim to bring the universality and accessibility of cash into the digital realm. And the much-publicized volatility of decentralized finance (DeFi) initiatives such as Bitcoin has further bolstered the case for CBDCs.

In 2023, 130 countries or currency unions were exploring or implementing CBDCs.4 Well-designed CBDCs have the ability to extend financial inclusion to the unbanked, as well as provide people with a means of participating in the digital economy even when they have no reliable access to the internet. What’s more, advanced CBDCs are being designed with interoperability at their core, so that they foster innovation and collaboration among private-sector companies that can use CBDC as platform to build customer-facing applications.

CBDC approaches are in stark contrast with those of crypto-assets, which tend to be used for speculative investment, are subject to wild swings in value, are grounded in commercial rather than societal interests, are subject to hacks, and take a “walled garden” approach, with little to no option for interoperability between platforms.

One of the most compelling arguments in favor of CBDCs is the possibility of programmable payments. While programmability already exist in a basic form in other areas of finance (direct debits, for example), CBDCs would make it possible to automatically execute transactions on digital currency stored in a “smart wallet” when specific conditions are met. This is particularly applicable to the IoT space, where the number of connected devices (some automatically executing payments) is expected to exceed 21 billion by 2026.5

CBDCs have the potential to revolutionize the way we look at currency and to contribute significantly at both a societal and economic level. A host of factors will underpin the success of CBDC rollouts in coming years, notably a comprehensive understanding of the market, targeted user segmentation, and phased launches to ensure integration with existing and future infrastructure and applications. Platforms such as G+D’s Filia® can be integrated into existing payment ecosystems, fostering inclusivity, security, and support for innovative financial services.

Trend 4: Payments adapting to a new generation

Despite predictions to the contrary, digitally native Generation Z is not wedded to online payment experiences. The generation coming of age in a world marked by the climate crisis, financial market shocks, geopolitical upheaval, and conflict, Gen Z is showing a newfound interest in the physicality of banknotes. For example, in tougher economic times, many are turning to “cash stuffing,” popularized on TikTok as a budgeting method that consists of putting aside predetermined amounts of cash in purpose-marked paper envelopes and spending those amounts in targeted ways each month.

As with the generations that came before them, intergenerational influence is strong among Gen Zs. Their first bank will often be the same as their parents’, but “zoomers” are also a source of influence for their parents, helping educate them about innovation in payment services.

When it comes to their own financial education, Gen Z tends to be proactive and self-driven, possibly due to uncertainties about their future. Many seek out financial advice on social media platforms, where financial influencers offer guidance on complex subjects such as budgeting and wealth management in short, digestible pieces of content.6 Financial institutions can leverage these platforms, stepping in as trusted advisors in order to highlight the benefits of cash as a tangible, stable, and socially conscious means of payment in an uncertain context.

These four trends offer a glimpse into a new world of public currency, where players across the cash cycles support the co-existence of physical and digital payments, providing consumers with a compelling set of options and capabilities. By coupling innovation and collaboration with inclusivity and sustainability, this ensures that coexistence will not just become a reality, but also remain healthy for a long time to come.

Key takeaways

- Physical cash remains crucial for economic stability and inclusivity, even as digital payment options increase.

- Cash centers are ensuring the resilience of the cash cycle by investing in advanced automation while at the same time prioritizing sustainability.

- CBDCs are emerging to complement cash and offer stable, secure digital currency options – in sharp contrast to the instability of cryptocurrencies.

- Generation Z is beginning to appreciate the unique characteristics of physical cash.

-

The paradox of banknotes: understanding the demand for cash beyond transactional use, European Central Bank, 2021

-

Obligation for major banks to provide certain cash services, Sveriges Riksbank, updated 2022

-

Paiement en espèces, Service-Public.fr, 2023

-

Central Bank Digital Currency Tracker, Atlantic Council, updated 2023

-

Number of Internet of Things (IoT) connected devices worldwide, Statista, 2023

-

Who uses social media for financial advice? Lots of people, actually, The Guardian, 2021

Published: 19/03/2024

Share this article

Subscribe to our newsletter

Don’t miss out on the latest articles in G+D SPOTLIGHT: by subscribing to our newsletter, you’ll be kept up to date on latest trends, ideas, and technical innovations – straight to your inbox every month.