Better banknote fitness testing in the cash cycle

Fit or unfit? When it comes to banknotes, central banks are continually balancing quality against cost. The BPS® Eco-Comparator software tool makes it possible for them to simulate threshold values for fitness themselves, and to select the optimal settings for banknote sorting. This saves time and money.

Banknotes need to be tough: they get creased, folded, and torn, as well as becoming soiled and being written on. As such, they are regularly put to the test – after all, banknote quality is a key factor for user confidence in any given currency. However, replacing banknotes is expensive, which makes it essential to find the ideal balance when determining banknote fitness. Machines from G+D are able to evaluate various parameters to this end. “Around 30 criteria are relevant in the day-to-day operations of central banks,” notes Dr. Marcus Schmeißer, Senior Product Manager for Compass Banknote Intelligence at G+D.

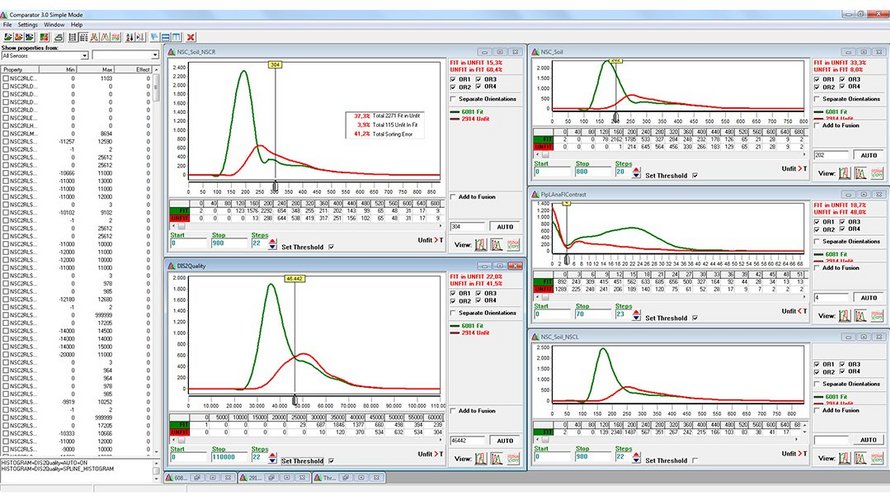

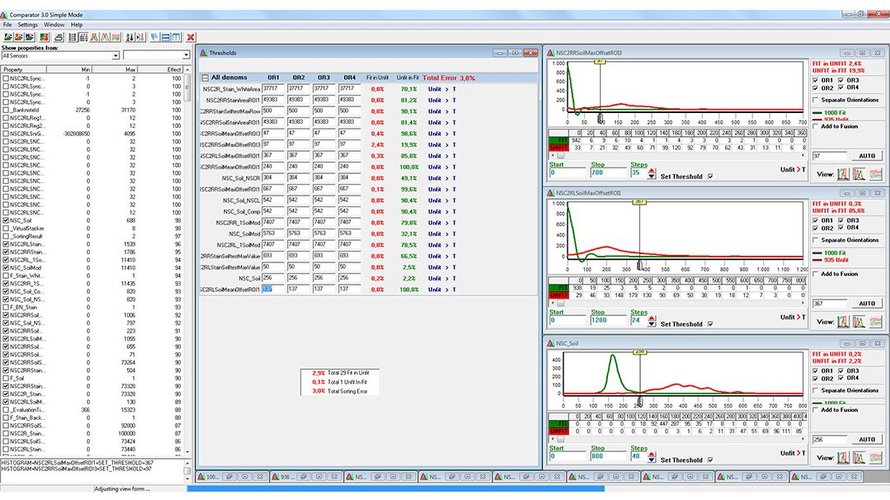

Graffiti, soiling, rips, dog-eared corners, and holes are among the most important fitness criteria. Each category can be measured in different locations on the banknote; additionally, values for the front and the reverse are measured individually. Threshold values also vary by denomination: notes in larger denominations need to be cleaner than the small ones. Each banknote series has around 300 quality criteria, making fitness inspection a complex matter. “When central banks are selecting the ideal threshold values for banknote condition, cost efficiency is the most important factor,” comments Schmeißer.

When central banks are selecting the ideal threshold values for banknote condition, cost efficiency is the most important factor.

Dr. Marcus Schmeißer, Senior Product Manager for Compass Banknote Intelligence

Searching for the perfect settings

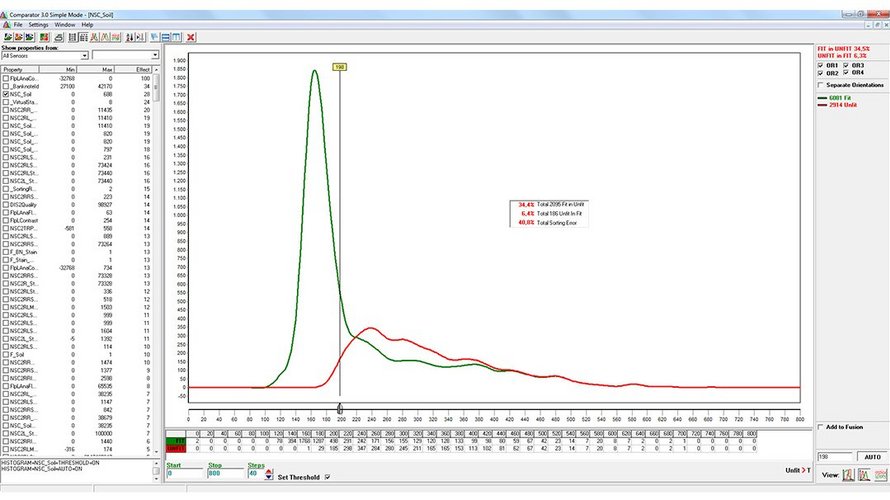

G+D provides central banks with the new BPS® M7 system for banknote processing, delivered with specific sorting quality settings. Of course, if the shredder rate is too high for the customer, or the threshold for fitness of soiled notes is too low, the machine will need to be readjusted. However, central banks increasingly want to set their own threshold values, in order to save time and money. The BPS® Eco-Comparator tool makes it possible for them to do so. The system is able to determine sorting thresholds from a limited amount of data, as well as provide simulations and make suggestions. The software learns in advance, from manually sorted banknotes, which notes should be classified as fit and which as unfit. “Central banks must find an optimal ratio between the two poles,” G+D expert Schmeißer explains. In this respect the European Central Bank (ECB) has also defined minimum requirements in Europe: A “false fit” rate of five percent or more indicates a negative impact on the currency’s image. Furthermore, the notes must fulfill technical requirements for circulation in order to prevent them jamming in ATMs and to ensure that they are always ready to use in the cash cycle. The false unfit rate is not regulated by the ECB, however – as errors here result solely in financial damage arising from incorrectly destroyed notes and the resulting costs for reprinting.

Balancing quality and costs

Option: optimizing both factors

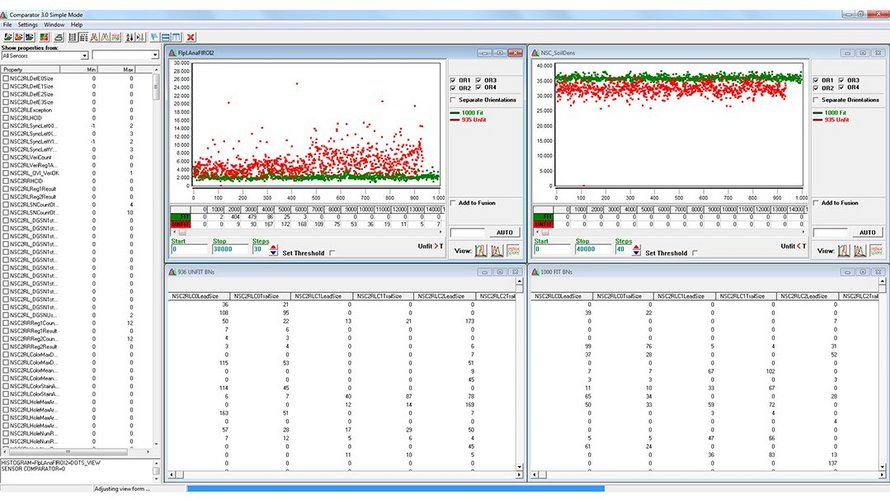

In order to train the BPS® M7, one stack of fit banknotes and one stack of unfit banknotes – each comprising at least 10,000 notes – are transferred to the machine. The BPS® Eco-Comparator software collates the data obtained from this exercise. The principle at work here is that initially analyzing higher volumes of notes results in a sharper distinction between fit and unfit. The tool is then able to calculate the ideal threshold values to enable the optimum classification of as many banknotes as possible.

Option: simulating fit and unfit

The central bank uses data from at least 10,000 circulated banknotes, and the tool uses this data to calculate the unfit rate based on current sorting thresholds. The customer is then able to explore other threshold scenarios for which the BPS® Eco-Comparator simulates the new unfit rate: How many banknotes would be destroyed if less contamination on the front side were acceptable? This enables the central bank to model how many banknotes it wants to reprint.

This method pays off quickly

In addition to buying a license for the BPS® Eco-Comparator tool, two training days with G+D experts are generally needed for in-depth familiarization with the BPS® “measurement instrument”, including adaptation to the relevant denominations. “A customer requires just one overall license, even if they have several BPS® machines, enabling a rapid return on investment,” Schmeißer confirms. If the cost of producing a banknote is €0.10, and the processing volume of a BPS® is around 500,000 banknotes per day, a 1% improvement in selection results in savings of around €100,000 per machine per year.

Productivity is also enhanced. Threshold optimization used to be complicated and time-intensive: many trial-and-error loops were required to adjust the BPS® machine to the ideal value. However, if customers use the tool themselves, they do not need to consult with engineers from G+D for threshold value modeling. The tool makes it possible to immediately visualize the effect on the unfit rate, and for all improvements to be transferred to the machines in just a few minutes. Software expert Schmeißer: “An increasing number of central banks rely on adjusting threshold values themselves, as this enables them to significantly enhance cost efficiency of their operations.”

Benefits of the BPS® Eco-Comparator

The autonomous in-house use of the BPS® Eco-Comparator tool offers central banks a range of operational benefits. These include:

- Increased independence: The customer uses the tool as the need arises, without having to consult experts from G+D

- Reduced costs: Changes to sorting thresholds enable immediate improvement to cost efficiency in the cash cycle.

- Enhanced productivity: Within minutes the new sorting thresholds can be transferred to all BPS® systems in use.

- Significant time savings: Eliminating the need for service technicians and remote transfer functions accelerates operational sequences in banknote classification.

The future of banknote processing is data intelligence

Get in touch

If you have any questions about our end-to-end business solutions or about our SecurityTech company, seek expert advice, or want to give us your feedback, our team is here to support you, anytime.