Shape the way you authenticate with Convego® AUTH-U

As a trusted financial institution, your customers rely on you to provide top-notch security and convenience, particularly when it comes to protecting their accounts and authenticating them. However, the proliferation of authentication channels means that managing access has become more complex.

Although the thought of migrating to a unified authentication solution may seem daunting, the risks of non-compliance and exposure to phishing attacks are much greater.

Shape the way you authenticate - with just the right amount of friction.

Imagine equipping your customers with a seamless, hassle-free way to authenticate their accounts, without the need to sacrifice security, and no more password resets or one-time passwords to worry about. With Convego® AUTH-U, you can offer your customers the ultimate levels of security, and peace of mind.

But it's not only about making things easier for your customers. You’ll be able to keep pace with the ever-evolving landscape of devices and channels that your customers use to access their finances. In addition, Convego® AUTH-U is based on the global FIDO authentication standard, so you can rest assured that you're adopting a passwordless authentication process, one that strikes the perfect balance between security, risk management, and convenience.

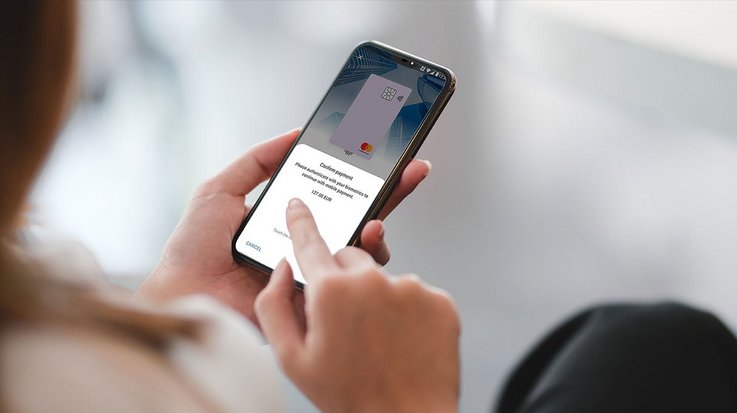

With Convego® AUTH-U, authentication feels invisible yet entirely secure – all you need for strong customer authentication is a touch of a thumb or a glance at a camera.

Meets the diverse needs of banks and financial institutions

- Smoother registration: Biometric authentication not only speeds up the time it takes to access mobile banking, but it also enhances the usage, providing consumers with instant added value.

- Convenient logins: Accessing accounts via native mobile applications and browser-based web apps is even easier with no passwords to remember.

- Secure transaction authorizations: Many transaction types, such as money transfers and high-value payments which are perceived as high-risk by customers, can be approved quickly and seamlessly using biometric options

- Improved e-commerce experience: Biometric authentication minimizes Card Not Present fraud while reducing cart abandonment rates compared to traditional 3D Secure passwords

Convego® AUTH-U: The future of passwordless authentication

Scalable proven platform

Convego® AUTH-U uses standard APIs which can easily integrate with your current process flows.

Enables rapid passwordless authentication

With biometrics, the entire authentication process is as easy as unlocking your phone. The FIDO-based technology under the hood keeps the second factor invisible to the user, making two-factor authentication feel as simple as one factor.

Unbeatable security

Our state-of-the-art security architecture leverages server-based biometric authentication, providing an extra layer of security to your services. Only those who are authorized will have access, not just those who possess access to the device.

Mitigate common cybersecurity threats

By using FIDO protocols, Convego® AUTH-U secures communication throughout the authentication process, and stores private keys and biometric information on decentralized users’ devices.

Achieve regulatory compliances

Our offering is fully compliant with PSD2, RBI, and other global regulations.

Offers a cross-channel experience

Protects your customers' privacy across a range of apps, devices, and digital services.

Future-proof solution

It provides the flexibility to easily integrate new upcoming authenticators when needed and leverages the expertise of the best authentication minds of the world working on the FIDO standard.

Case study

Learn how our exceptional solution for a commercial European bank not only bolstered security but also transformed the customer experience through passwordless authentication. It allowed their customers to enjoy a secure yet effortless authentication experience, with biometrics and FIDO under the hood providing an invisible yet robust layer of security.

Trend reports

Why banks need to move beyond passwords and PINs?

Explore how to optimize customer experience and security in the finance sector and deliver exceptional experiences with passwordless authentication!

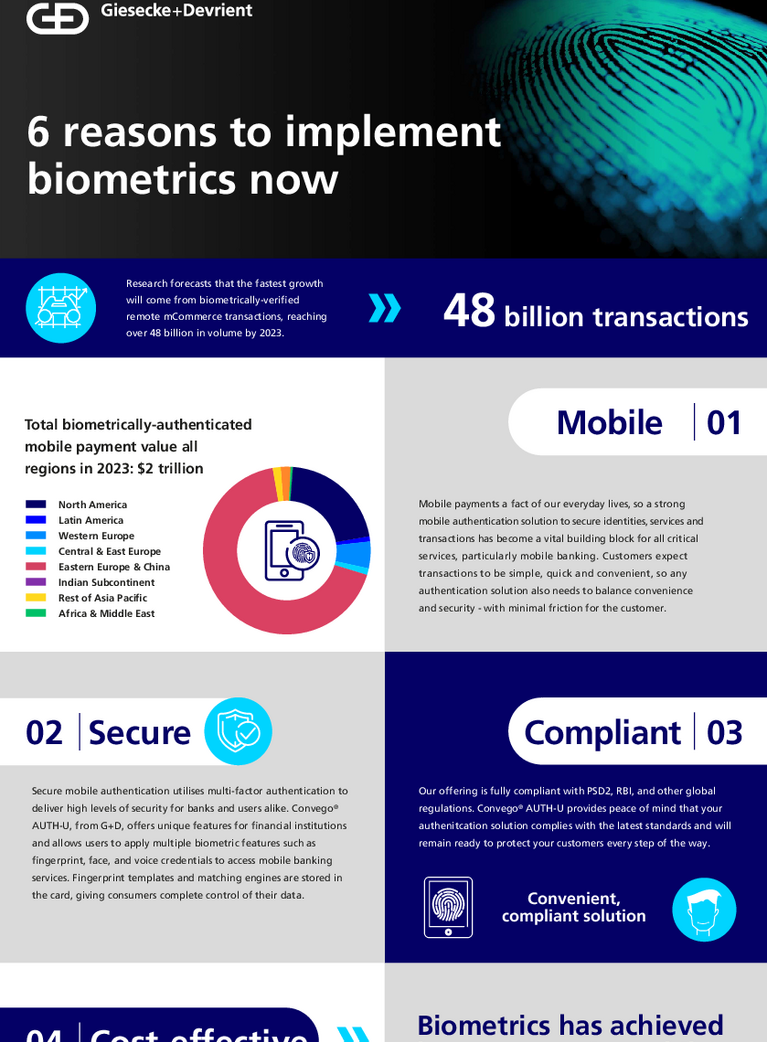

6 Reasons to implement biometrics now

Authentication serves as the gateway to numerous digital services, and it's no secret that traditional authentication approaches are neither convenient nor entirely secure.

Explore some compelling reasons why you should implement biometrics now.

How secure is SMS in authenticating identities?

SMS as a second factor of authentication is not as safe as once imagined – but there are alternatives like FIDO that strike a perfect balance between robust security and seamless experience whilst also maintaining regulatory compliance. Explore how the future of authentication is shaping.

Partner with the trusted experts at G+D

For the last 170+ years, our mission has been to create innovative solutions that safeguard critical industrial sectors. With G+D as a partner, banks and financial institutions can concentrate on their core business – without having to constantly worry about how to safeguard the identity of their customers.

Get in touchRelated Solutions

Get in touch

If you have any questions about our end-to-end business solutions or about our SecurityTech company, seek expert advice, or want to give us your feedback, our team is here to support you, anytime.